Funds were buyers again yesterday on reports of poor Ukrainian export port operations due to Russians not allowing inbound vessels to transit effectively, also that Russian officials were not issuing phyto certs on cargos from last week that had traded below the minimum price that Russia has issued but that was resolved later in the day

Wheat futures are mixed to lower. Recent bounce also linked to talk of drier weather lowering final US, Canada, Australia and Russia 2023 wheat crop and technically, Chic July was oversold.

Interesting that now parts of US HRW may be getting too wet and raising questions about quality. KC July has had a wild price ride in May from 7.36 to 9.18 back to 8.07 and now testing key resistance near 8.50. Still a lot on unanswered questions about Ukraine corridor.

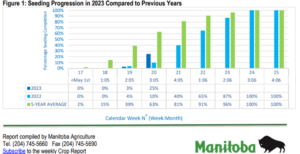

The path of least resistance remains lower for the grains, with the 2023 crop off to a good start for most, and North American supplies generally ignored in most export markets.

Soybeans in particular are taking it on the chin with China slow to secure new crop North American exports, snapping up as much of Brazil’s record harvest as they can.

Wheat exports have slowed from the Black Sea up into the deal deadline last week and with Russia protesting almost daily, but U.S. export prices are still non competitive on the world market.

Taiwan’s MFIG bought 65k tonnes of Brazilian corn in an international tender this morning for August shipment; the tender was dominated by offers for Brazilian corn, with no offers for U.S. corn reported.

South Korean millers bought 135k tonnes of milling wheat yesterday morning, including 50k each from the U.S. and Australia and 35k from Canada, for Aug-Sept shipment. U.S. prices ranged from the mid $260’s per tonne (for U.S. soft white wheat) up to around $340/tonne for Australian hard wheat.

Ukraine is accusing Russia of effectively blocking the port of Pivdennyi by refusing to inspect ships bound for that destination; the port, which handles large tonnage vessels and is the largest port included in the Black Sea grain deal, has not received any new ships since May 2. Russia used to transport ammonia to Pivdennyi via pipeline before the war, and restarting that pipeline was one of Russia’s demands that they say have not yet been met.

Brazilian exporting association Anec estimated May soybean exports at 15.9 MMT, up from 15.76 MMT last week, with corn exports at 387k tonnes, down from 571k previously, and meal at 2.49 MMT vs 2.6 MMT LW.

Private firm Agroconsult yesterday raised their 2022/23 Brazilian safrinha corn crop estimate from 97.2 to 102.4 MMT, ahead of a crop tour of several states; they see plantings steady but record yields up 11% year over year, all despite planting delays in Parana and those late crops remaining at risk.

European Commission data showed cumulative 2022/23 E.U. soft wheat ex-pors at 28.0 MMT, up 13% from last year’s 24.86 MMT pace, with corn im-ports through May 21 at 23.99 MMT, up 63% from last year’s 14.7 MMT.

Mpls wheat -5

KC wheat -8

Chic wheat -6

Matif wheat -4

Canola -5

Rapeseed -1

Soybeans +1

Soybean oil -2

Crude +142

Corn +1

CAD-22