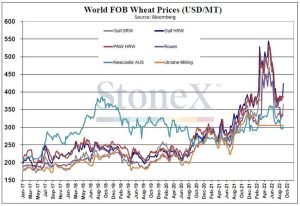

World Q3 wheat exports are down 9 mmt from last year due to high prices and weaker currency

The grains are looking to slink into the end of the week amid low trade volume and completing a week long decline off highs

The trade (and the government) has its doubts about the size of 2022 U.S. row crops but ultimately won’t be able to verify until combines get into the fields

Grain trade group Coceral this morning cut their 2022 E.U. corn production estimate from 66.0 to 51.9 MMT, down from 70.2 MMT last season; soft wheat output fell from 143.0 to 140.5 MMT, versus 143.4 MMT in 2021.

FranceAgriMer finally published an unchanged corn condition ratings week over week, at 43% good/excellent this week, that compares to 89% at this point last season. The harvest advanced from 5% to 14% this week, with the 2021 corn harvest having yet to begin at this point.

UkrAgroConsult reported the 2022 Ukraine grain harvest at 26 MMT, from 6.78 million hectares (16.75 mln acres); wheat was 99% done on 4.7 mln ha (11.6 mln ac), at 19.2 MMT, with corn 0.3% complete on 12k ha (just over 30 thousand acres), at 64k tonnes thus far.

The chief agronomist for the Rosario Grains Exchange said that they would likely cut their 2022/23 corn planted acreage estimate in their monthly report next week, currently standing at 8.2 million hectares (20.3 mln acres), due to widespread drought causing “the worst planting scenario in the last 27 years. Some towns had their lowest June-August rainfall since 1933.

Mpls wheat -3

KC wheat -5

Chic wheat -5

Matif wheat -2

Canola -2

Rapeseed -7

Soybeans -6

Soybean oil +71

Crude +88

Corn -3

CAD -40